For all UK businesses who are trading internationally all products for either Export or import need to be classified for legal purpose.

Classifying your goods is a critical part of international trade.

When importing goods into the UK there is a need for UK businesses to declare the imports to HMRC and pay all duties and taxes on those goods.

This can be done either;

- on first arrival into the UK

- or as part of a Customs Special procedure such as Inward Processing (IP), Customs Warehouse (CW) or Customs Freight Simplification procedure (CFSP)

It is the importer who is responsible for making the correct import declaration, even if you have outsourced this to your freight forwarder/customs agent to do the customs entries for and on your behalf as a direct representative of your business. There large penalties in place for making false declarations.

What is tariff classification?

Tariff classification is a process for determining the correct code number for your goods, to enable them to be accurately recorded. The key uses are for statistical purposes at import or export. This allows for the collection of statistics for UK trade and to confirm the correct collection of customs duties. Using the correct code also ensures that the correct regulations that may apply to the imported or exported goods are followed.

For some commodities it will be easy to select the correct number. For others, it will be a more difficult procedure to understand what the goods are, the raw materials used to manufacture then produce and, in some cases, its end use.

The Harmonised System (HS)

Good classification is not just limited to the UK, it is a global system used by customs authorities worldwide to identify products without the fundamental problems in the translation of descriptions. The tariff number, which is also known as a “commodity code” identifies goods for customs processes.

The UK’s system is known as the UK Global tariff (UKGT) it is comparable with the EU’s system of Combined Nomenclature (CN) both are based on the global system of classification known as the Harmonised Commodity description and coding system of the Customs Co-operation Council.

The World Customs Organisation (WCO) controls all matters relating to Customs regulations and the classification of goods. Please note that the customs duty rates are not harmonised (except within the EU)

Globally, most countries use the standard coding system (HS) as a basis for their own tariff. This makes it easier to clearly identify products for statistical use, it also helps with the standardisation of rules and regulations.

How import and export codes are derived

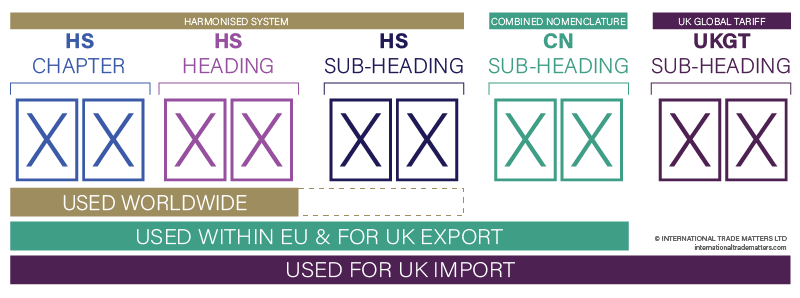

The HS commodity code comprises a series of numbers. The First four are recognised worldwide, the first two represent the chapter to which the goods apply, and an additional two digits (6 in all) giving more details.

In addition, the EU use an eight-digit code, which is the same in each member state, to identify products moving within the union. While imports into the UK from anywhere require and extra 2 digits making the UKGT Import Tariff 10 digits long.

The 10-digit figure begins with a general description of the products and develops, dependent on the variety of those products and in some cases, the use of the goods.

Working example

The following example is described by Wikipedia:

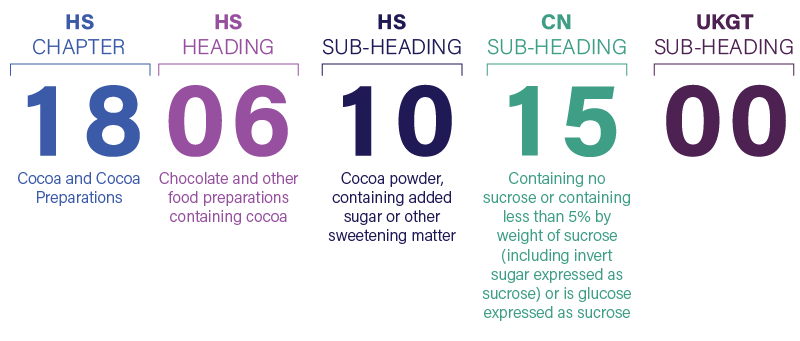

- HS Chapter – 2 digits – E.g. 18 – Cocoa and Cocoa Preparations

- HS Heading – 2 digits – E.g. 1806 – Chocolate and other food preparations containing cocoa

- HS Sub Heading – 2 digits – E.g. 1806 10 – Cocoa powder, containing added sugar or other sweetening matter

- CN Sub Heading – 2 digits – E.g. 1806 10 15 – Containing no sucrose or containing less than 5% by weight of sucrose (including invert sugar expressed as sucrose) or is glucose expressed as sucrose

- UKGT Sub Heading 2 digits – E.g. 1806 10 15 00

In this case;

UK Import code will be: 1806 10 1500 (10 digits)

UK Export code will be: 1806 10 15 (8 digits)

From 1st January 2022, traders will need to implement changes to tariff codes

As mentioned in Mike’s previous update, the UK introduced its 2022 Integrated Tariff at the beginning of the year. Read the update HERE

Want to learn more?

Get in touch with Mike Court and the team of international trade specialists today!